Risk-free bonds are a theoretical concept in finance, referring to an investment that guarantees return without any risk of financial loss. The idea is that the bond issuer has a 100% probability of fulfilling their debt obligations, meaning that the investor will receive the agreed interest payments and the return of the principal at maturity.

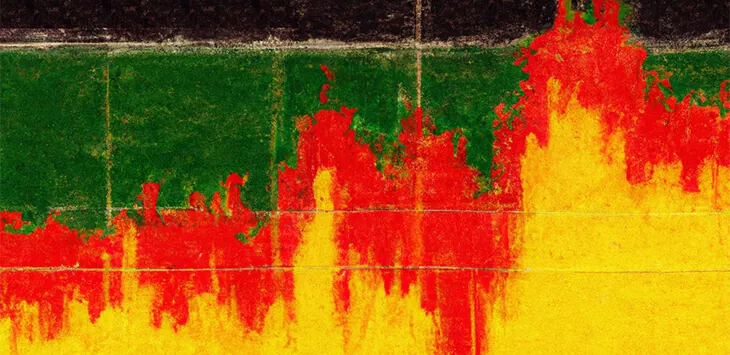

The Japanese real estate market experienced one of the most significant crashes in history during the late 1980s and early 1990s. This was a notable event in economic history. The asset bubble, as it was called, was fueled by excessive lending by Japanese banks, low-interest rates, and speculative investment.