Despite sluggish overall growth reported in the National Accounts, a range of more partial indicators suggest the Australian economy is enjoying reasonable – though not robust – growth from a diversified range of sources. Continued moderate growth and low inflation appear the most likely outcome over the coming year, which would be consistent with steady local interest rates and a focus on income over growth opportunities in the Australian equity market.

Contrary to the hopes of both the Reserve Bank of Australia and the Federal Treasury, economic growth is off to a bad start in 2017 so far. Importantly, however, the recent Federal Budget included new powers for the Australian Prudential Regulation Authority to impose geographic-based lending restrictions. If used, these new restrictions could allow scope for the Reserve Bank to further support the economy through lower interest rates later this year if need be, with less risk of further inflaming the already hot Sydney property market.

Continued industry growth and inflows into Australian Equities ETFs

The Australian ETF industry recorded another strong month of growth, with total industry FuM at the end of May hitting a new high as the industry nears the $30B mark. Total industry FUM at month end was $29.0B, with growth of 2.6% or $730M for the month. In a month where the Australian market tumbled, almost all the growth came from net new money, rather than asset appreciation.

The Reserve Bank of Australia has recently indicated that this Wednesday’s September quarter consumer price index report will be a critical factor when its Board sits to decide on interest rates next Tuesday (Melbourne Cup day). What’s more, there is a reasonable chance that inflation will (again) surprise on the downside. Despite this risk, the market is placing only relatively small odds on a rate cut next week.

The Australian dollar has proven stubbornly resilient in recent months, thanks to firm iron ore prices and reluctance on the part of the United States Federal Reserve to raise US interest rates. This note updates our valuation model of the Australian dollar, particularly in light of recent comments by the Reserve Bank suggesting the terms of trade may have already bottomed. Based on the analysis, my year-end call for the A$ is 0.72c, declining to 0.68c by mid-2017.

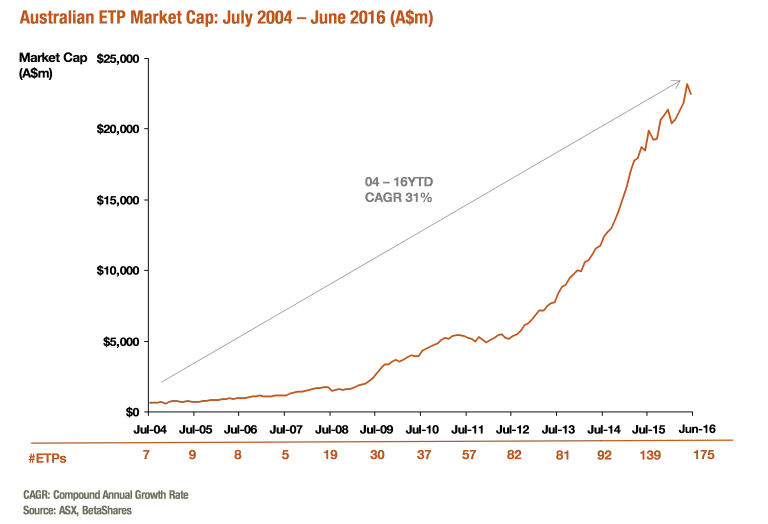

The Australian exchange traded fund industry grew by 5%, or $1.1B, during the first half of 2016, despite the challenging market conditions, ending the financial year with total funds under management of $22.5B. June was especially turbulent with the Brexit vote and the Australian election all adding to ongoing volatility. Investors continued to support ETFs by investing almost $1.4B in new money into the industry during the last 6 months meaning that all the industry’s growth this half has come from structural growth, with asset price declines actually being a net negative for the industry as a whole.

The industry continues to mature during 2016 with 16 new products added and 10 closed so far this year. We expect the number of new products to grow significantly during the last half of the year in what will be another strong year for product launches.

The United Kingdom’s decision to leave the European Union has thrown global markets into turmoil in recent days. Given the result was the opposite of market expectations, the knee-jerk response was understandable, though likely overstated Brexit’s global (and hence Australian) impact. That said, Brexit is potentially devastating for the UK over the near-term, and to the European Union over the longer-term. What’s more, the Brexit shock comes at a vulnerable time for global markets, given sluggish earnings growth and elevated equity market valuations.

The impending United Kingdom referendum on European Union membership remains a major “event risk” for global markets over the coming month. That said, polling suggests the chances of the UK leaving the Union after this vote are diminishing, which means there might be scope for at least a short-term “relief rally” for the British Pound. More broadly, however, it’s worth noting that UK equities have underperformed their continental counterparts in recent years, and lingering concerns over the UK’s commitment to the European Union suggests investors might consider European investments that exclude the United Kingdom.

The recently released minutes to the Reserve Bank of Australia’s May policy meeting – at which it cut official interest rates – highlighted the fact that it was near-term downside risks to inflation, not economic growth, that encouraged the Bank to act. Given the challenge of pushing underlying inflation back up, it seems likely that the RBA will cut interest rates at least once more this year. Ultimately, however, this is a very pro-growth development which could usher in a return to above-trend economic growth and better stock market performance.