Navigate money 8

View Transcript

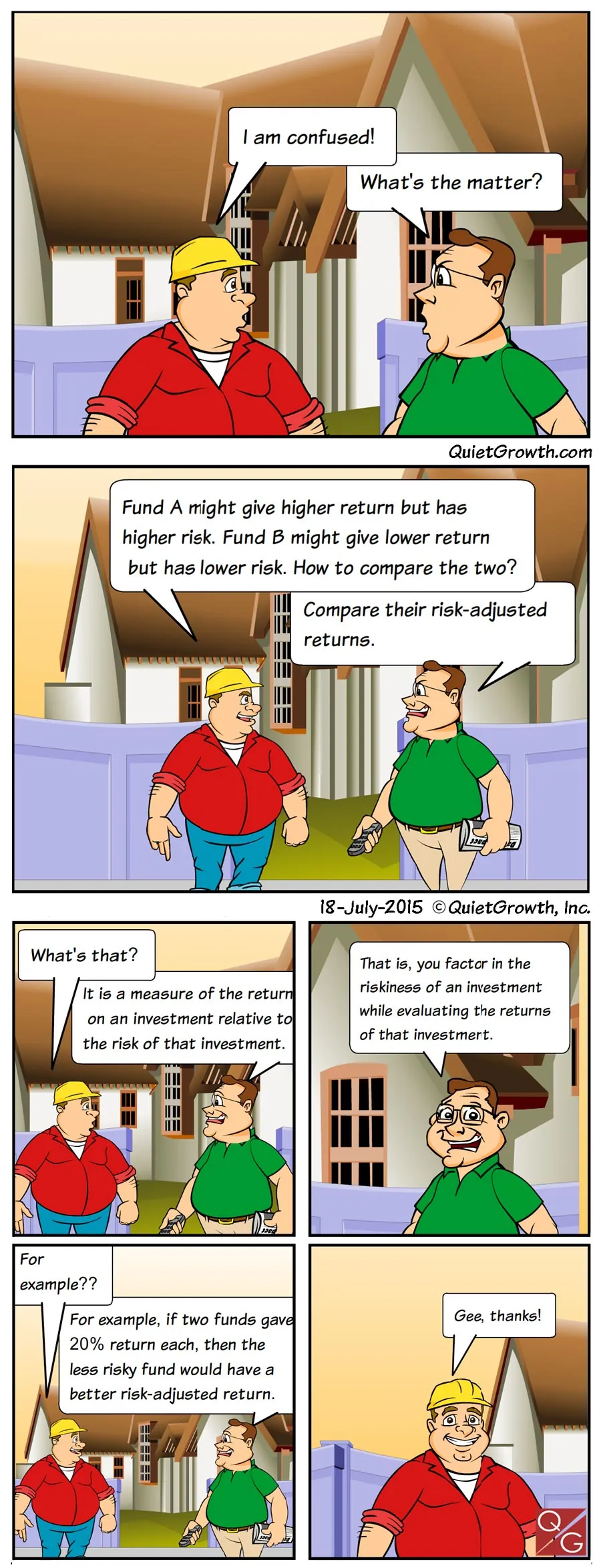

Person 1: I am confused!

Person 2: What’s the matter?

Person 1: Fund A might give higher return but has higher risk. Fund B might give lower return but has lower risk. How to compare the two?

Person 2: Compare their risk-adjusted returns.

Person 1: What’s that?

Person 2: It is a measure of the return on an investment relative to the risk of that investment.

Person 2: That is, you factor in the riskiness of an investment while evaluating the returns of that investment.

Person 1: For example??

Person 2: For example, if two funds gave 20% return each, then the less risky fund would have a better risk-adjusted return.

Person 1: Gee, thanks!

Related information

Refer to the related knowledge resources:

Also read the answers to the related questions: