The Australian dollar has proven stubbornly resilient in recent months, thanks to firm iron ore prices and reluctance on the part of the United States Federal Reserve to raise US interest rates. This note updates our valuation model of the Australian dollar, particularly in light of recent comments by the Reserve Bank suggesting the terms of trade may have already bottomed. Based on the analysis, my year-end call for the A$ is 0.72c, declining to 0.68c by mid-2017.

Keep up to date with the latest rates and contribution limits.

1. Concessional contribution limits

Annual contribution limits for 2016/17 financial year:

| Concessional contributions (before-tax) | |

| Age 49 and over on 30 June 2016 | $35,000 |

| All others | $30,000 |

2. Non-concessional contribution (after-tax) limits

The Government announced in the Federal Budget that from 7.30pm (AEST) on 3 May 2016, non-concessional (after-tax) contribution caps have been replaced with a $500,000 lifetime cap. This cap takes into account all after-tax contributions made since 1 July 2007. It applies to individuals aged up to 75 years.

As part of the 2016 Federal Budget, Treasurer Scott Morrison presented the Government’s Superannuation Reform Package. The reforms centre on supporting the official objective of superannuation, “to provide income in retirement to substitute or supplement the Age Pension.

In his budget delivery speech, the Treasurer announced that the reforms are intended to improve the fairness of the superannuation system for women and lower income earners, while reducing the extent to which super is used by the wealthy for tax-minimisation or estate planning purposes.

According to the Treasurer:

- 96% of people will be unaffected by changes to superannuation tax concessions for higher income earners

- More than 4% of people will benefit from changes intended to improve the equity of the superannuation system for women and lower income earners.

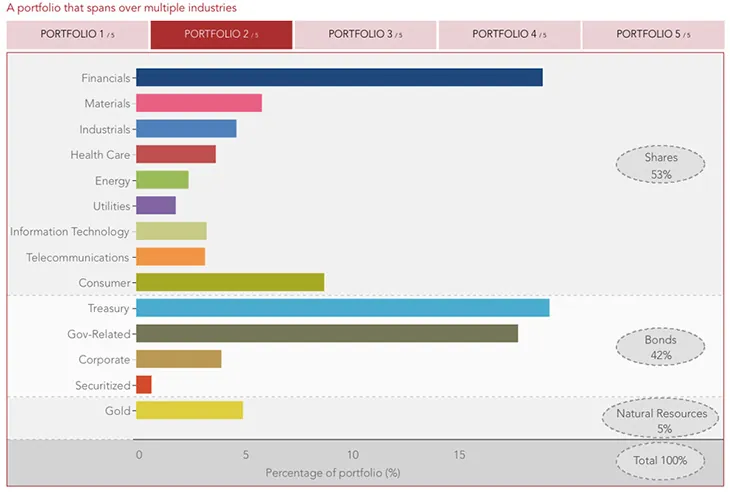

We now have a new interactive interface to show the industry mix of various QuietGrowth portfolios. You can check the interactive in the ‘Why QuietGrowth’ section of our website.