We’ve all heard that old clichéd saying ‘the early bird catches the worm’ – so how can being the early bird help you to increase your super savings?

When should you start investing? The sooner the better.

When you first start working and investing for the future, you have the benefit of time on your side. In fact, time is probably your most valuable asset.

So what’s an investor to do? The answer is: start investing as early as possible. Maximise the power of compounding.

Early in your career you may not have saved much in terms of investable financial assets, but you do have the opportunity to take maximum advantage of compounding. Even a small nest egg, created early, can become a large one over many years.

When it comes to your wealth, compounding is like a snowball rolling downhill, growing and accelerating over time. This is because your investments within super can grow not only by your contributions, but also by the earnings that accumulate over time. The end result is that your super savings can grow faster and faster the longer you stay invested.

Start saving more now. Every year you wait diminishes the power of compounding.

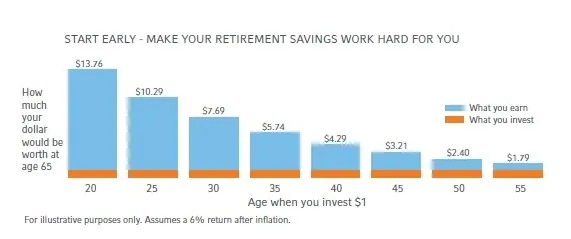

The chart below highlights this concept. It compares how much a $1 investment is worth at age 65, depending on the age at which you invest it. In this example, every single dollar a 20-year-old invests is worth $13.76 at retirement. A 40-year-old, on the other hand, can only expect $4.29 at retirement from that same one dollar investment. It’s never too late to start investing for retirement or other long-term goals, but, the earlier you start, the greater the potential benefit of compound interest—your investments actually working for you towards achieving your long-term goals.

Beyond the power of compounding, starting earlier provides additional financial flexibility, simply because you have more set aside for retirement. Trying to play catch up with your nest egg gets increasingly difficult as you age. You may be tempted to take on additional investment risk in hopes of additional return. You’d be taking on that additional risk at the time in your life when you may want to take on less. A smaller late-in-life nest egg may mean you need to save more, work longer, or spend less in retirement—all choices most of us would rather avoid.

| Start early and perhaps you can: | Start late and you might have to: |

|

|

|

|

|

|

|

|

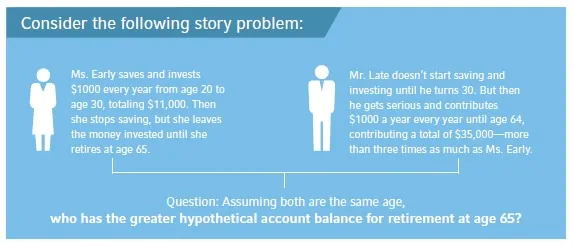

Remember the scenario we posed at the beginning of this article?

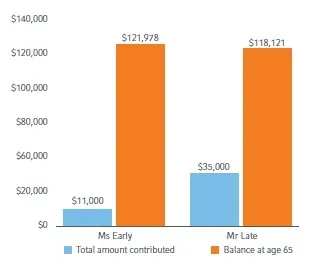

You probably already guessed that Ms. Early earned more by age 65, even though she contributed far less than Mr. Late. Of course, the best option is to combine a little bit of both their tactics. Start investing early and keep contributing as long as you can.

But start now. The power of compounding depends on the rarest of all commodities: time.

At age 65 Ms. Early has a higher account balance than Mr. Late despite contributing far less to her retirement. By starting earlier and leaving it invested, her money has more time to compound.

The bottom line.

At any age, let the power of compounding work for you. The earlier you start, the harder your investments can work towards achieving your long-term retirement goals.

This post was written by Russell Investments and published on their website at this link. Russell Investments has given permission to QuietGrowth to publish this blog on its website.

Copyright 2016. Russell Investments. All rights reserved. This material is proprietary and may not be reproduced, transferred or distributed in any form without prior written permission from Russell Investments.

QuietGrowth has been publishing content in this blog or in other sections of the website. Contributors for this content may include the employees of QuietGrowth, or third-party firms, or third-party authors. Unless otherwise noted, such content does not necessarily represent the actual views or opinions of QuietGrowth or any of its employees, directors, or officers.

Any links provided in our website to other websites are for the purpose of convenience, or as required by any such other websites. Unless otherwise noted, this does not imply that QuietGrowth endorses, is affiliated, and/or promotes any information, or products or services of those websites. Please read the advice disclaimer section of the website too.