Navigate money 56

View Transcript

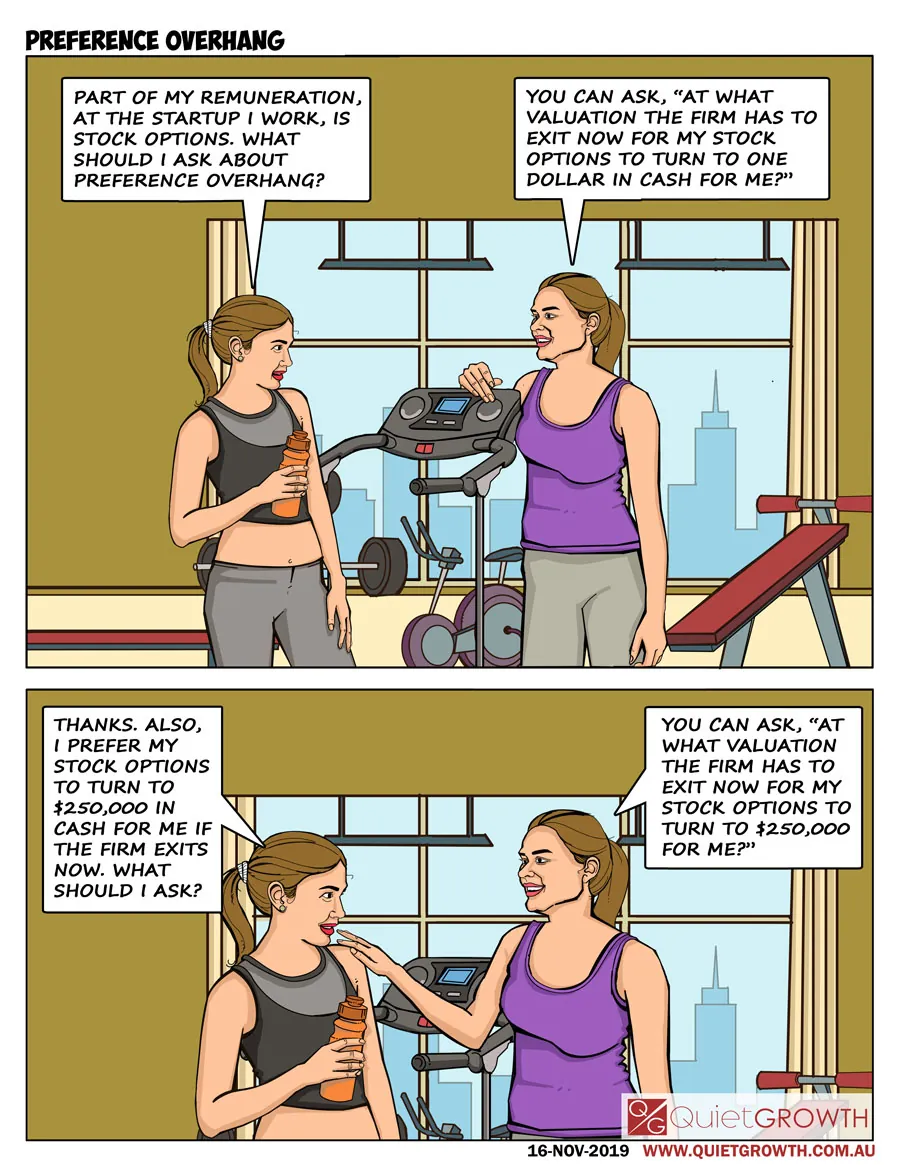

An employee owning startup equity should understand the risk of preference shares arising at the time of liquidation. Our illustration describes how the employee can become aware of liquidation preference overhang.

Navigate money 56

View Transcript

An employee owning startup equity should understand the risk of preference shares arising at the time of liquidation. Our illustration describes how the employee can become aware of liquidation preference overhang.