Continued industry growth and inflows into Australian Equities ETFs

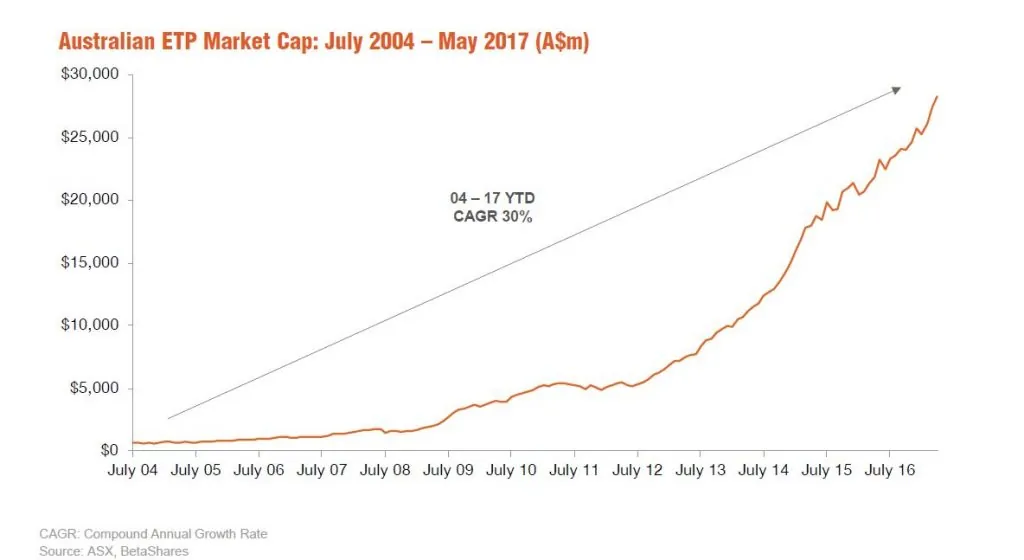

The Australian ETF industry recorded another strong month of growth, with total industry FuM at the end of May hitting a new high as the industry nears the $30B mark. Total industry FUM at month end was $29.0B, with growth of 2.6% or $730M for the month. In a month where the Australian market tumbled, almost all the growth came from net new money, rather than asset appreciation.

Market Cap

- ASX Exchange Traded Funds Market Cap: $29.0B – New record high

- Market cap growth for month: +2.6%, + $733.7m

- Market cap growth for last twelve months: 25.1%, +$5.8B

Comment: We’re excited to be getting close another ’round number’ milestone of $30B. Growth trajectory for the industry continues to be robust.

New Money

- New unit growth for month (units outstanding by number): 3.0%

- Net new money (units outstanding by $ value): +$657.8m

Products

- 206 Exchange Traded Products trading on the ASX

- 2 new products launched this month -VanEck Vectors Australian Corporate Bond Plus ETF (ASX: PLUS) and UBS IQ Cash ETF (ASX: MONY)

Comment: Over the next quarter, we expect to see more products based on the cash & fixed income. BetaShares recently launched our first bond fund, for example, our Australian Bank Senior Floating Rate Bond ETF (ASX: QPON).

Trading Value

- Average trading value up 44% to be the second largest trading month on record (first largest set in February 2017)

Performance

- Asian Equities and BetaShares Australian Equities Strong Bear Hedge Fund (ASX: BBOZ) the best performers this month

Top 5 category inflows (by $) – May 2017

| Category | Inflow Value | |

| Australian Equities | $ 329,024,194 | |

| International Equities | $ 202,022,526 | |

| Fixed Income | $ 69,184,475 | |

| Commodities | $ 39,293,600 | |

| Australian Listed Property | $ 22,900,867 | |

Top category outflows (by $) – May 2017

| Category | Outflow Value | |

| Currency | ($ 7,031,273) | |

| Cash | ($ 4,861,572) | |

Top sub- category inflows (by $) – May 2017

| Category | Inflow Value | |

| Australian Equities – Broad | $ 248,128,970 | |

| Australian Equities – High Yield | $ 80,771,568 | |

| International Equities – Developed World | $ 76,299,954 | |

| Australian Bonds | $ 53,279,231 | |

| International Equities – Sector | $ 36,515,110 | |

Top sub- category outflows (by $) – May 2017

| Category | Outflow Value | |

| Australian Equities – Large Cap | ($ 10,633,455) | |

| Currency | ($ 7,031,273) | |

| Cash | ($ 4,861,572) | |

Ilan Israelstam is the Head of Strategy & Marketing for BetaShares. BetaShares is an Australian manager of funds which are traded on the Australian Securities Exchange. BetaShares offers a range of exchange traded funds which cover Australian and international equities, cash, currencies, commodities and alternative strategies. Author website: www.betasharesblog.com.au/author/ilanisraelstam

This post was originally published at the BetaShares Blog at www.betashares.com.au/insights/etf-review-may-2017

QuietGrowth has been publishing content in this blog or in other sections of the website. Contributors for this content may include the employees of QuietGrowth, or third-party firms, or third-party authors. Unless otherwise noted, such content does not necessarily represent the actual views or opinions of QuietGrowth or any of its employees, directors, or officers.

Any links provided in our website to other websites are for the purpose of convenience, or as required by any such other websites. Unless otherwise noted, this does not imply that QuietGrowth endorses, is affiliated, and/or promotes any information, or products or services of those websites. Please read the advice disclaimer section of the website too.