The impending United Kingdom referendum on European Union membership remains a major “event risk” for global markets over the coming month. That said, polling suggests the chances of the UK leaving the Union after this vote are diminishing, which means there might be scope for at least a short-term “relief rally” for the British Pound. More broadly, however, it’s worth noting that UK equities have underperformed their continental counterparts in recent years, and lingering concerns over the UK’s commitment to the European Union suggests investors might consider European investments that exclude the United Kingdom.

Odds Favour the “Stay” Vote

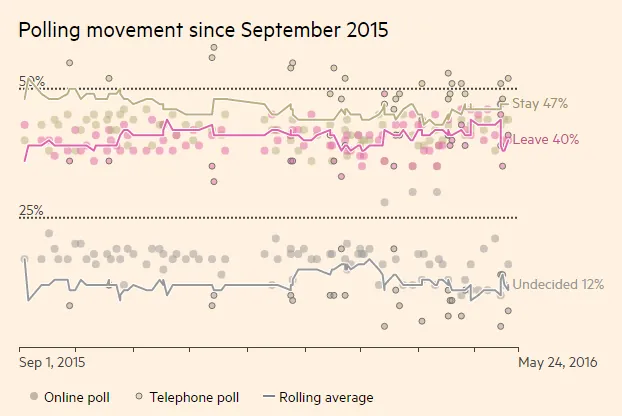

As seen in the chart below, the Financial Times Brexit Poll Tracker – which summarises the results from various national polls – suggests the “stay” vote still retains the edge. Indeed, in recent weeks there appears to have been a dip in those favouring a leave vote, with many of these voters moving into the undecided camp. This suggests growing voter apprehension about the potential economic and financial implication of the UK leaving the EU, particularly in light of many high profile organisations and individuals (including US President Barack Obama and Bank of England governor Mark Carney) that have issued warnings about the consequences.

Source: Financial Times Brexit Poll Tracker

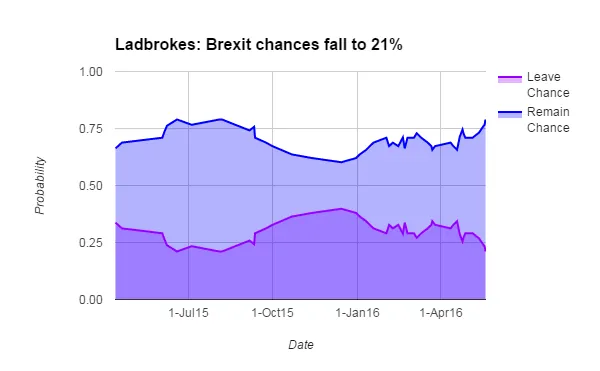

Probably even more telling are the results from betting markets. Although traditional polling still suggests a relatively close result, especially with a critical group still undecided, betting markets have long suspected the “stay” vote was much more likely to win. Indeed, the probability of the “stay ” vote prevailing has generally increased since the referendum was officially announced on 20 February.

Source: Ladbrokes

The Pound Could Bounce

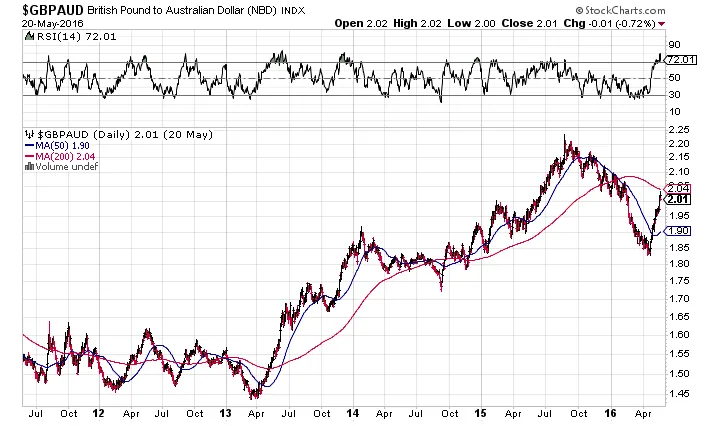

As we suggested in an earlier piece on the Brexit vote, the beaten down British Pound has staged a rebound in recent weeks as the odds of the “stay” vote getting up have shortened. Assuming the stay vote does win out, the Pound could potentially resume the trend rise against the Australian dollar that has been evident since early 2013. The case for further Pound gains against the Australian dollar is strengthened by the chances of further local interest rates cuts by the Reserve Bank of Australia (as we explained here), together with a resumption of commodity price weakness after a brief flurry higher in recent months.

Source: Stockcharts.com

UK Equities have underperformed

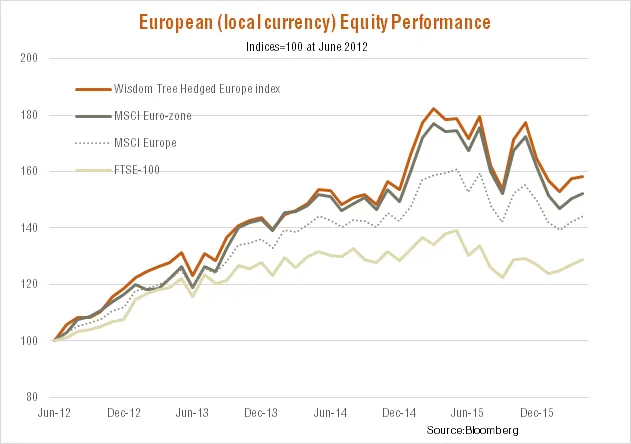

Longer-term, however, the UK’s wavering support for EU membership does pose some political risks. Some companies seeking a foothold in Europe, for example, may come to question basing the centre of their operations in the United Kingdom. London’s role as a European financial centre could also come under greater scrutiny.

Against this background, it’s also worth noting that the UK equity market has generally underperformed that of the Euro-zone in recent years. One factor is the UK’s generally higher exposure to mining and energy stocks, which have suffered due to the decline in global commodity prices. Another factor has been more aggressive monetary stimulus from the European Central Bank, which has also contributed to relative weakness in the Euro against the Pound and improved Euro-zone export competitiveness. Indeed, it remains the case that the ECB President Mario Draghi has promised to do “whatever it takes” to avoid deflation taking hold in the Euro zone, which could mean even more quantitative easing and Euro weakness going forward.

David Bassanese is the Chief Economist for BetaShares. BetaShares is an Australian manager of funds which are traded on the Australian Securities Exchange. BetaShares offers a range of exchange traded funds which cover Australian and international equities, cash, currencies, commodities and alternative strategies. Author website: www.betashares.com.au/insights/author/david-bassanese

This post was originally published at the BetaShares Blog at www.betasharesblog.com.au/uk-likely-to-dodge-the-brexit-bullet