Resources Weigh on Earnings

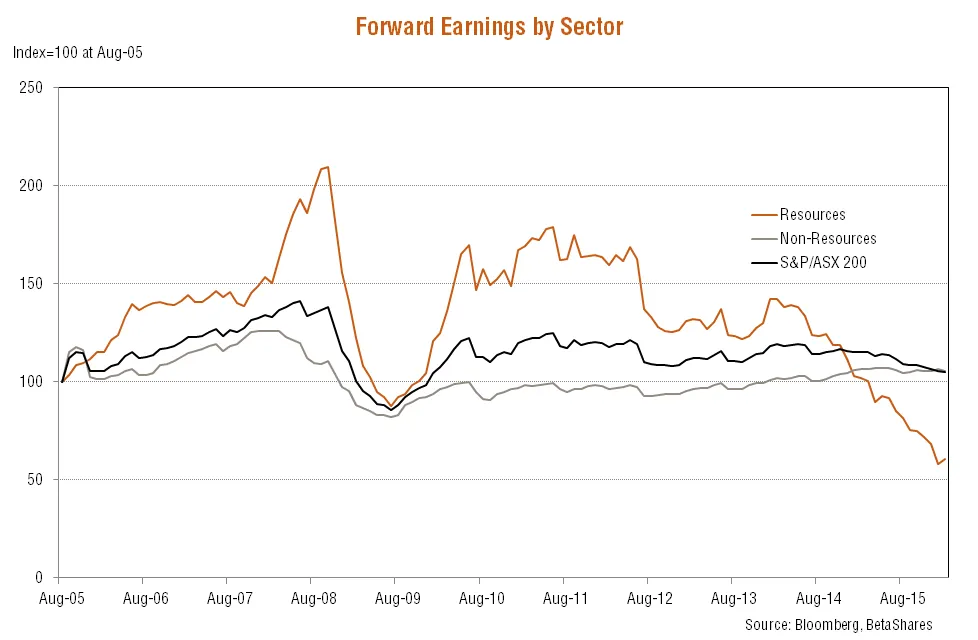

As we have warned for some time, it’s been hard for the local equity market to rise in a sustained way against the backdrop of weak corporate earnings. As seen in the chart below, overall forward earnings for the market have been broadly flat for the past five years, with a declining trend even evident in the past year or so due to the accelerated decline in resource sector earnings. Outside of the resource sector a gradual pick-up in forward earnings has been evident over recent years, though even here earnings did slip back slightly over the past twelve months.

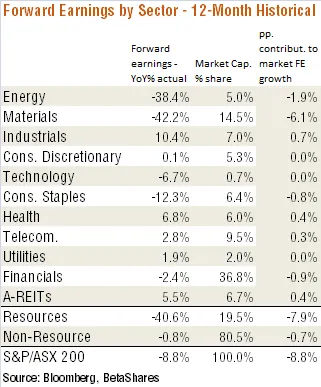

In the twelve months to end-February, resource sector forward earnings (calculated as the market-cap weighted average of material and energy sector forward earnings) fell by 41%, while non-resource sector forward earnings declined by 0.8%. Overall, forward earnings for the market declined by 8.8%.

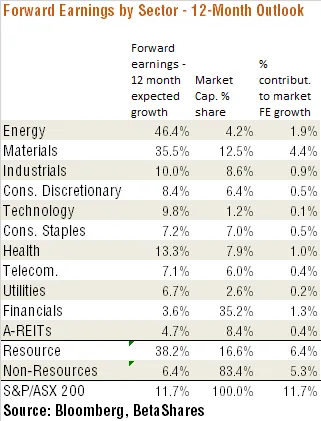

Looking at sector performance in detail over the past year – and apart from the obvious slump in resource sector earnings – the stand out performers have been industrials, health care and listed property. In turn, this largely appears to reflect the benefits of low interest rates helping property valuations, while the weaker $A has helped boost the value of offshore earnings in the industrials and health care sectors. Increasing competition also hurt earnings in the consumer staples and telecommunication sectors.

Is the Worst over for Resources?

In view of the major slump in commodity prices in recent years, it would be tempting to suggest the worst might soon be over for the sector. To some extent, resource companies do have some earnings upside – due to both the likelihood of further weakness in the $A (which boosts the value of offshore earnings), and ongoing expansion in resource export volumes over the coming year.

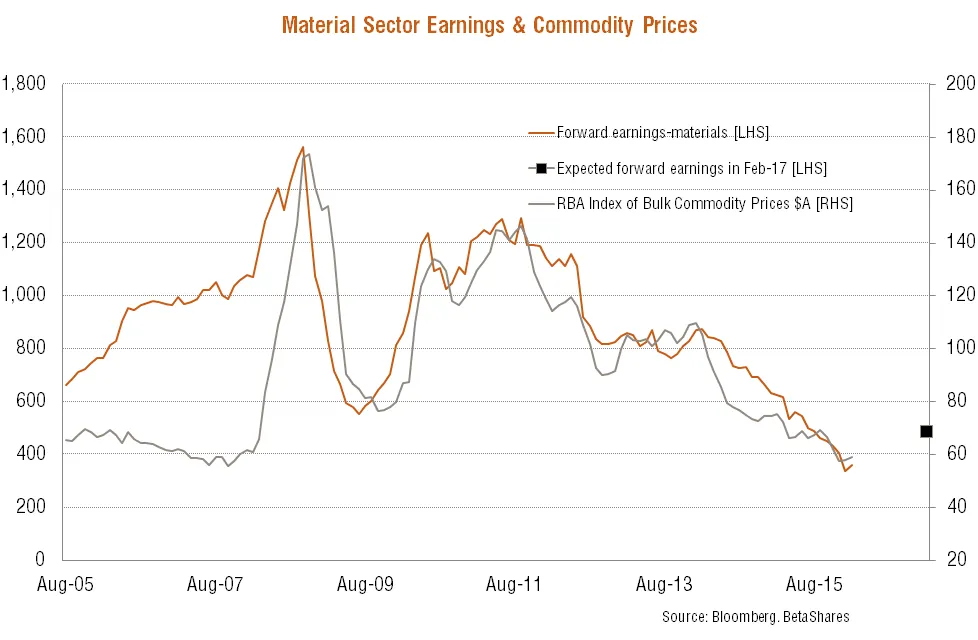

That said, as seen in the chart below, forward earnings in the materials sector (which accounts for 75% of the resources sector) still remains critically dependant on the outlook for commodity prices. According to Bloomberg current consensus earnings estimates, forward earnings in the materials sector are expected to rise by 36% over the coming twelve months, which seems a big ask if commodity prices don’t rebound solidly.

Of course, with the decline in resource sector prices in recent years, the sector is not as important to the market as it once was. That said, the very large swings in earnings that are possible within the sector suggest it can still have quite out-sized influence on overall market earnings.

As seen in the chart below, even though the resource sector (comprising materials and energy) now accounts for only around 16% of total market capitalisation, it is expected to contribute almost one-half of the growth in market forward earnings over the coming year. In short, the market’s earnings outlook still remains heavily dependant on a somewhat questionable rebound in commodity prices.

David Bassanese is the Chief Economist for BetaShares. BetaShares is an Australian manager of funds which are traded on the Australian Securities Exchange. BetaShares offers a range of exchange traded funds which cover Australian and international equities, cash, currencies, commodities and alternative strategies. Author website: www.betashares.com.au/insights/author/david-bassanese

This post was originally published at the BetaShares Blog at www.betasharesblog.com.au/local-equities-at-mercy-of-commodities