Among the issues investors need to consider when buying and selling exchange traded funds (ETFs) are buy and sell spreads. Spreads are often seen as an unavoidable cost of trading and investing, and are not unique to ETFs per se. What’s more, the competitive nature of open exchange markets – as well as the impact of dedicated market makers – help to ensure ETF bid-offer spreads are as tight as possible.

What are buy-sell spread, and why should I pay them?

An ETF’s buy-sell spread is the difference between the price at which investors can buy the ETF on the exchange and the (lower) price at which it could be sold back to the market. This ‘spread’ can be seen when looking at the websites of online brokers and is also displayed by the ASX on the market data pages of its website.

Clearly, the narrower the spread the better, as this reduces the trading costs associated with buying and selling ETFs. That said, the fact that ETF trading is subject to buy and sell spreads should not be considered a major negative for investors. After all, the issue of buy and sell spreads is not unique to ETFs.

Indeed, it should be remembered that all securities traded on the ASX are subject to buy and sell spreads, as this is the way the professional trading houses that invest their time and financial risk by standing ready to buy and sell these securities at an investor’s behest – effectively making markets and enhancing liquidity – are compensated. What’s more, even unlisted investment funds are subject to buy and sell spreads, which can be a combination of entry/exit fees levied by the fund manager and/or an allowance for estimated transaction costs incurred in buying and selling underlying investments.

How are spreads calculated?

It should be noted that, unlike the situation with unlisted funds, the buy and sell spreads for exchange traded securities like ETFs are not set by the product providers (such as BetaShares) or even effectively by the market makers that quote them.

Instead, exchange based spreads as on the ASX are set by the competitive tensions between market markers. If a market maker’s spreads are too wide, it will lose business to other markers makers that are able to maintain tighter spreads.

As in the case of company shares more broadly, the size of the spreads that ETF markets makers are able to competitively maintain naturally depends on liquidity factors, such as the frequency and average size of trades involved. For that reason, spreads on larger companies – which are subject to more extensive trading activity – are typically tighter than for smaller companies.

The same considerations apply for ETFs. ETFs that invest in liquid underlyings (which applies to most of the ETFs available on the ASX), have a large number of investors and a large total value of units outstanding may have more liquidity than an ETF that does not have some or any of these features, which should result in somewhat tighter spreads. Similarly, ETFs which invest in relatively illiquid underlying assets such as small companies, will have a higher spread than an ETF which invests in larger, more liquid, “blue chip” stocks.

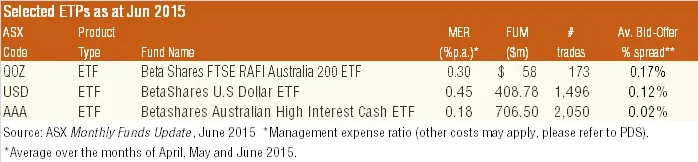

The table below provides indicative bid-offer spreads for selected BetaShares funds.

David Bassanese is the Chief Economist for BetaShares. BetaShares is an Australian manager of funds which are traded on the Australian Securities Exchange. BetaShares offers a range of exchange traded funds which cover Australian and international equities, cash, currencies, commodities and alternative strategies. Author website: www.betashares.com.au/insights/author/david-bassanese

This post was originally published at the BetaShares Blog at www.betasharesblog.com.au/etfs-101-understanding-etf-bid-and-offer-spreads