The Reserve Bank of Australia has recently indicated that this Wednesday’s September quarter consumer price index report will be a critical factor when its Board sits to decide on interest rates next Tuesday (Melbourne Cup day). What’s more, there is a reasonable chance that inflation will (again) surprise on the downside. Despite this risk, the market is placing only relatively small odds on a rate cut next week.

September quarter CPI looms large

The RBA has clearly indicated that the September quarter CPI result will influence its thinking on interest rates.

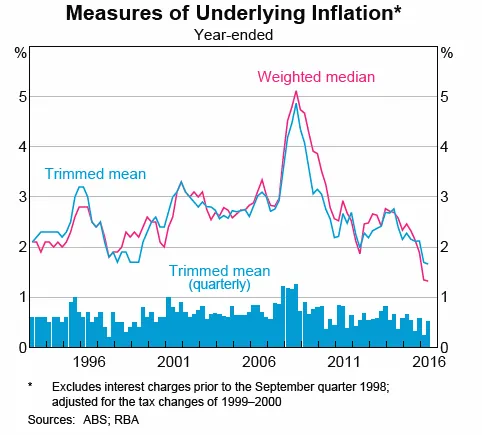

In a recent speech, for example, newly installed RBA Governor Phillip Lowe indicated that it was the lower than expected inflation results earlier this year that caused the RBA to cut official interest rates from 2% to 1.5%. Indeed, contrary to the RBA’s expectations, annual growth in its preferred measures of underlying inflation (the trimmed mean and weighted median) dropped below 2% in the March quarter, and held at this lower level in the June quarter. Annual underlying inflation has not been below 2% since the late 1990s.

By cutting rates, Lowe indicated a major concern was not to let inflation expectations drop too low, as “if this were to occur it would be more difficult to achieve the [2 to 3%] inflation target”. He went on to add, moreover, that “one of the key influences on inflation expectations is the actual outcomes for inflation. We will get an important update next week, with the release of the September quarter CPI.”

This comment follows on from a reference in the minutes of the October RBA Board meeting which stated “Members noted that data on CPI inflation for the September quarter and an update of the forecasts would be available at the next meeting. This would provide an opportunity to consider the economic outlook, assess the effects of previous reductions in the cash rate and review conditions in the labour and housing markets.”

To my mind, this is a strong signal that the RBA stands ready to cut interest rates next week if the annual underlying inflation drops further in the September quarter. Specifically, should annual underlying inflation drop to 1.25% or less (after rounding), the RBA is likely to cut rates, whereas it will likely leave interest rates on hold if annual underlying inflation holds steady at 1.5%, or rises somewhat. At the margin, the recent softening in employment growth and still firm $A will also likely influence RBA thinking.

A low inflation result is quite possible

According to Bloomberg consensus estimates, the RBA’s preferred measures of underlying inflation are both expected to have risen by 0.4% in the September, which would keep annual underlying inflation broadly steady (in rounded terms) at 1.5%.

To achieve a decline in annual underlying inflation to 1.25% would require a quarterly rise across both underlying inflation measures of around 0.2%. To my mind, that’s entirely possible, as it would represent a quarterly outcome in line with those in the March quarter. Adding to the case for a low inflation result is still low wage growth and the waning effects of past exchange rate weakness on import inflation. Indeed, the September quarter average for the $A (vs the $US) was 1.6% higher than the June quarter average, which in turn was 3.3% higher than the March quarter average.

Adding to the uncertainty, many government-controlled prices tended to be adjusted annually in the September quarter, meaning seasonal adjustment factors have a larger than usual bearing on the quarterly outcome.

Despite these risks, however, the market is currently attaching only a 15% chance to a rate cut next week.

Either way, however, it would be best if rates stay on hold

To my mind, however, there are good reasons why the RBA should remain on hold next week – despite its apparent intentions otherwise – even if the inflation report is lower than expected.

For starters, the recent strength in the $A (which could have helped to lower inflation last quarter) is partly justified by the recent rebound in commodity prices and apparent stabilisation (at least for now) in the terms of trade. The economy is also on a surer footing than it was earlier this year, with gains in business confidence and a further decline in the rate of unemployment. I also maintain that much of the decline in inflation is structural in nature (reflecting downward pressure on profit margins and technology-driven cost improvements), which in turn is helping boost real incomes. Cutting rates to battle this decline in inflation may prove ineffectual, against which must be balanced the greater financial stability risks of over inflating home and equity prices.

Last, but not least, given interest rates are already very low, the RBA should be mindful of the need to “save its ammunition” to guard against downside risks in 2017, especially if commodity prices fall back heavily and/or the housing construction boom unwinds.

Investment implications

A downside surprise to inflation and a surprise RBA rate cut could give the local equity market an added boost next week and could bring back into favour high yielding sectors such as listed property, financials and telecommunications. It could also take the edge off the $A.

Heading into 2017, however, my sense is the RBA will eventually become mindful of the risk from taking rates ever lower, and will begin to signal a more neutral policy bias even if it implies greater toleration of below-target inflation over the short-term.

This post was originally published at the BetaShares Blog at www.betasharesblog.com.au/rba-cut-is-the-dark-horse

David Bassanese is the Chief Economist for BetaShares. BetaShares is an Australian manager of funds which are traded on the Australian Securities Exchange. BetaShares offers a range of exchange traded funds which cover Australian and international equities, cash, currencies, commodities and alternative strategies. Author website: www.betashares.com.au/insights/author/david-bassanese

QuietGrowth has been publishing content in this blog or in other sections of the website. Contributors for this content may include the employees of QuietGrowth, or third-party firms, or third-party authors. Unless otherwise noted, such content does not necessarily represent the actual views or opinions of QuietGrowth or any of its employees, directors, or officers.

Any links provided in our website to other websites are for the purpose of convenience, or as required by any such other websites. Unless otherwise noted, this does not imply that QuietGrowth endorses, is affiliated, and/or promotes any information, or products or services of those websites. Please read the advice disclaimer section of the website too.