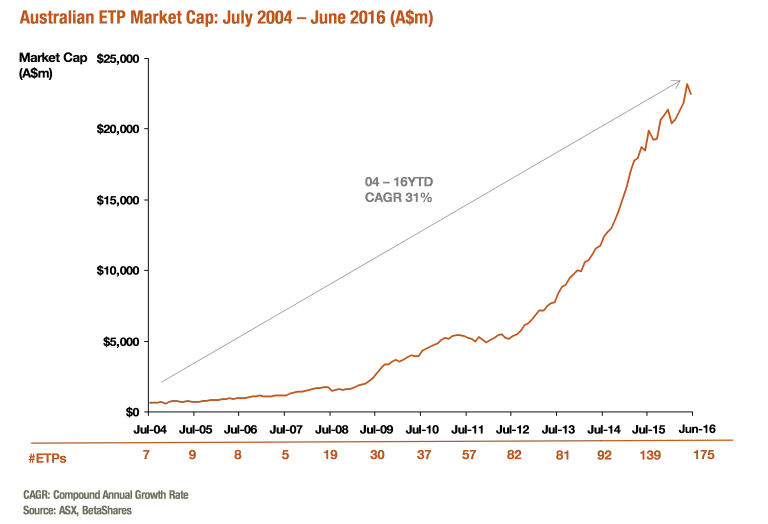

The Australian exchange traded fund industry grew by 5%, or $1.1B, during the first half of 2016, despite the challenging market conditions, ending the financial year with total funds under management of $22.5B. June was especially turbulent with the Brexit vote and the Australian election all adding to ongoing volatility. Investors continued to support ETFs by investing almost $1.4B in new money into the industry during the last 6 months meaning that all the industry’s growth this half has come from structural growth, with asset price declines actually being a net negative for the industry as a whole.

The industry continues to mature during 2016 with 16 new products added and 10 closed so far this year. We expect the number of new products to grow significantly during the last half of the year in what will be another strong year for product launches.

Market Size & Growth

- ASX Exchange Traded Funds Market Cap: $22.5B

- FuM growth for half year: 5.2%, +$1.1B

- FuM growth for last twelve months: 21.8%, +$4.0B

New Money

- New unit growth for half year (units outstanding by number): +14.6%

- Net new money for half year (units outstanding by $ value): +$1.4B

- New unit growth for June (units outstanding by number): -0.2%

- Net new money for June(units outstanding by $ value): +$26.8m

Products

- 175 Exchange Traded Products trading on the ASX

- 16 new products launched in the half year, with 10 closures recorded

Comment: BetaShares launched 3 new products during June 2016 which included the first two actively managed products launched under the new BetaShares/AMP Capital alliance, the AMP Capital Global Infrastructure Securities Fund (Unhedged) (Managed Fund) (GLIN) and the AMP Capital Global Property Securities Fund (Unhedged) (Managed Fund) (RENT). We also launched the first in a series of global sector ETFs, the BetaShares Global Energy Companies ETF – Currency Hedged (FUEL)

Trading Value

- 175 Exchange Traded Products trading on the ASXAverage trading value decreased 11% compared to previous half year period

- During June the trading values decreased by 29% month on month

Performance

Gold exposures (physical gold bullion & gold miners) were the strongest performers for the first half of 2016.

Top 5 category inflows (by $) – Half Year 2016

| Category | Inflow Value | |

| International Equities – Developed | $239,722,364 | |

| Australian Equities – Broad | $199,392,684 | |

| International Equities – Global | $198,424,594 | |

| Aus. High Yield | $139,092,540 | |

| Short | $130,153,571 | |

Top 5 category outflows (by $) – Half Year 2016

The “Style” category was the only to record outflows for the half year, to the value of -$47,120,271.

Top 5 category inflows (by $) – June 2016

| Category | Inflow Value | |

| International Equities – Developed | $95,580,604 | |

| Currency | $65,016,920 | |

| A-REIT | $39,560,072 | |

| Aus. High Yield | $19,147,989 | |

| Resources | $18,795,647 | |

Comment: Inflows were highest in international equities exposures during June, followed by strong inflows into the BetaShares U.S. Dollar ETF as investors retreated to safe haven assets

Top 5 category outflows (by $) – June 2016

| Category | Outflow Value | |

| Australian Fixed Income | -$112,434,660 | |

| Australian Equities – Broad | -$100,801,833 | |

| Cash | -$47,471,974 | |

| International Equities – Emerging Markets | -$3,326,748 | |

Comment: Whilst the largest outflows came in Australian Fixed Income and Broad Australian equities we suspect both those outflows were the result of single institutional trades rather than broader market selling.

Ilan Israelstam is the Head of Strategy & Marketing for BetaShares. BetaShares is an Australian manager of funds which are traded on the Australian Securities Exchange. BetaShares offers a range of exchange traded funds which cover Australian and international equities, cash, currencies, commodities and alternative strategies. Author website: www.betasharesblog.com.au/author/ilanisraelstam

This post was originally published at the BetaShares Blog at www.betasharesblog.com.au/etf-review-half-year-2016