The recent rebound in the price of gold in light of heightened financial market volatility should serve as a reminder to investors of the “safe haven” properties that this precious metal can offer. What’s more, should more central banks resort to negative interest rate policy (NIRP) in the face of slowing global growth, gold’s safe haven status could take on added lustre.

Gold can play a safe-haven role

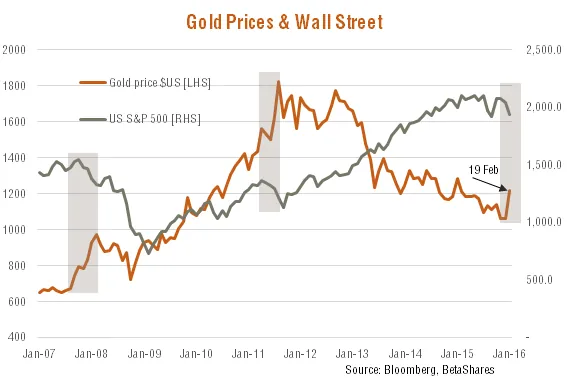

As seen in the chart below, the broad correlation between gold prices and global equities can vary over time. Both equities and gold enjoyed a broadly positive correlation during the commodity price boom (which ended in 2011), and which also tended to be associated with a weaker US dollar. With the recent phase of global equity market strength favouring non-resource sectors and the US dollar, the correlation between gold and equities since 2011 has turned more negative.

That said, irrespective of broad trends, recent history also suggests that gold has tended to act as a safe haven during periods of abrupt equity market volatility. Indeed, gold prices enjoyed particular strength during the early stages of the global financial crisis (before everything was sold in a desperate flight to liquidity) and gold again rose during the last decent US stock market correction in 2011. Gold prices have also bounced back solidly during the retreat in equity prices so far in 2016.

Negative Interest Rates could Enhance Gold’s Role as a Safe Haven

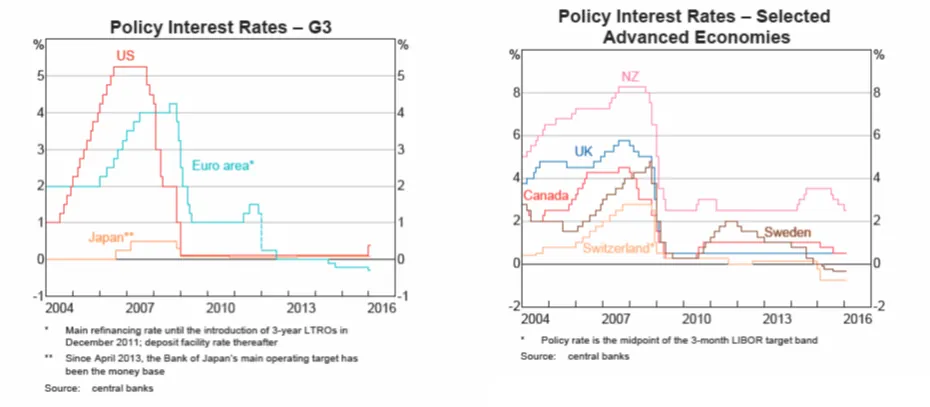

The further short-term interest rates move into negative territory, the less appealing will be cash as a safe-haven asset (as investors will now be paying banks for the privilege of holding their cash).

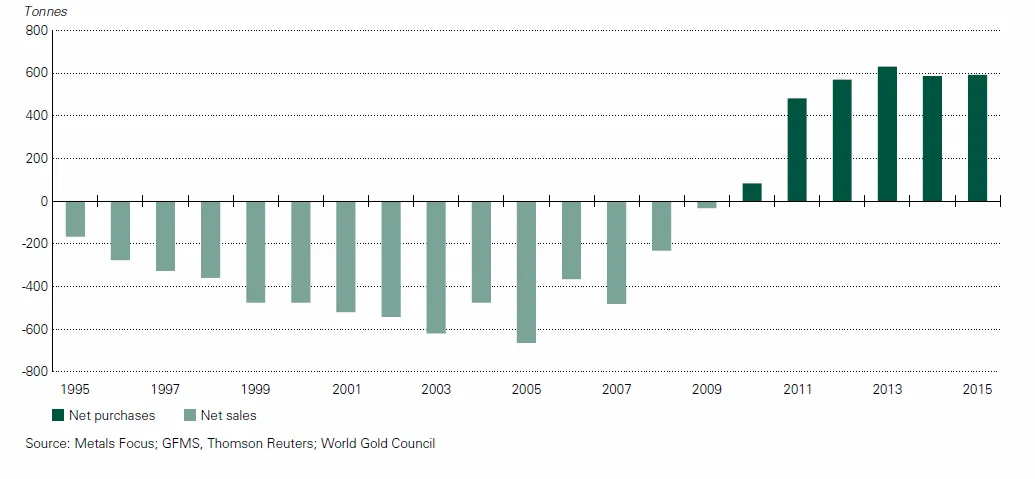

Central Banks Getting in on the Action

David Bassanese is the Chief Economist for BetaShares. BetaShares is an Australian manager of funds which are traded on the Australian Securities Exchange. BetaShares offers a range of exchange traded funds which cover Australian and international equities, cash, currencies, commodities and alternative strategies. Author website: www.betashares.com.au/insights/author/david-bassanese

This post was originally published at the BetaShares Blog at www.betasharesblog.com.au/negative-rates-positive-for-gold