Understanding why the RBA cut rates (again)

Many analysts have been surprised by the RBA’s lurch back toward rate cuts since May even though the economy has been travelling well, and the June quarter inflation results were broadly in line with the RBA’s expectations. To my mind, this portrays a lack of understanding over how the RBA operates.

For starters, although the economy has been “OK” over the past year – with the unemployment rate broadly stable – as I’ve previously argued, the lower than expected inflation outlook following the March quarter consumer price index result effectively gave the RBA the green light to pursue not just trend economic growth, but above-trend economic growth so as to lower the unemployment rate from higher than necessary levels. This much is now evident in the RBA’s claim in the August SMP that “while the prospects for economic growth are positive, there is room for even stronger growth.”

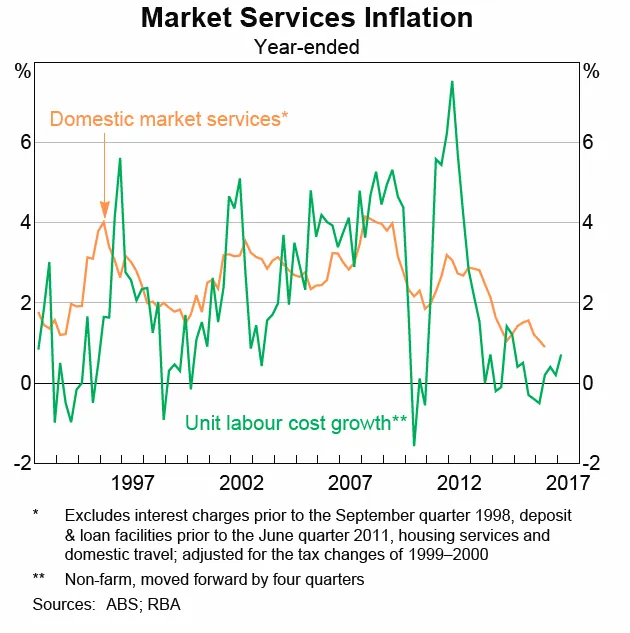

Note although strong retail competition and rising housing supply are positive forces holding down some consumer prices and rents, the RBA still attributes some of the weakness in prices more broadly to lingering spare labour market capacity and associated weakness in wage growth. Indeed, as seen in the chart below, unit labour costs have barely grown in recent years, which has helped notably slow service sector inflation. For this reason, the RBA still feels it worthwhile to respond to price weakness by cutting interest rates – so as to lower unemployment and lift wage growth.

Another source of confusion was why the RBA again cut rates this month even though the June quarter CPI results were only broadly in line with RBA expectations – with underlying inflation up around 0.5% in the quarter, and 1.5% over the year.

That RBA did not need to be surprised to justify another cut this time around – rather it just needed confirmation that the low inflation result it was expecting in fact came to pass. The still relatively low inflation result for the June quarter was confirmation that the low March quarter result was not a “rogue” number as some had suggested. All up, the RBA has responded to a 0.5% decline in its medium-term underlying inflation expectation (from 2% to 1.5%) by also cutting official interest rates by 0.5%.

Inflation remains critical to the interest rate outlook

To my mind, the key decider of whether the RBA cuts interest rates again will be whether it can retain its forecast of underlying inflation rising to 2% YoY by the June quarter 2017, from 1.5% YoY in the June quarter.

If underlying inflation rises to 2% by June next year, it will be consistent with the RBA’s 2-3 percent inflation target and interest rates can remain on hold. However, if inflation stubbornly holds at 1.5% (or even less), the RBA may seemingly have little choice but to cut rates to encourage even stronger economic growth, lower unemployment, and higher wage inflation.

Clearly, the first hint that inflation is unlikely to rise as much as the RBA expects will come from the next set of CPI results. If underlying inflation remains very weak in the September quarter results – such that annual underlying inflation drops to 1.25% – the RBA will likely cut in November. However, a drop in annual underlying inflation that quickly would require quarterly gain of 0.2% or less, i.e. close to that achieved in the March quarter. That’s possible, but perhaps not likely.

Another path to a rate cut is if annual underlying inflation drops to 1.25% by the December quarter CPI results due in late January. That’s possible if quarterly underlying inflation gains over the next two quarters average no more than 0.3%. Given broad based muted price pressures, such an outcome remains quite possible.

Of course, a sudden weakening in the economy and/or uncomfortable rise in the $A toward US80c (say because of delayed Fed tightening) could also bring forth rate cuts. But barring these developments, the outlook for interest rates remains critically dependant on the outlook for inflation.

All up, another rate cut seems more likely than not – though the RBA could hold off until February. By this time it will have two further CPI inflation results to review and we’ll know if the Fed managed to raise rates in December.

The good news in all this is, as I’ve argued repeatedly in recent months, that the RBA is effectively targeting a return to above trend economic growth and falling unemployment. The economy faces challenges, but at least the RBA is firmly on its side.

David Bassanese is the Chief Economist for BetaShares. BetaShares is an Australian manager of funds which are traded on the Australian Securities Exchange. BetaShares offers a range of exchange traded funds which cover Australian and international equities, cash, currencies, commodities and alternative strategies. Author website: www.betashares.com.au/insights/author/david-bassanese

This post was originally published at the BetaShares Blog at www.betasharesblog.com.au/market-insights-another-rate-cut-more-likely-than-not