The holiday is definitely over! The markets have experienced a horror start to 2016. While losses were sustained across global share markets, it was an opportunity for the exchange traded fund industry to display its resilience amongst the turmoil.

The industry recorded a contrary position to the overall market and saw positive inflows for the month with just over $100m of new money entering the market, although the overall value of the exchange traded fund contracted by -4.3%.

Market Size & Growth

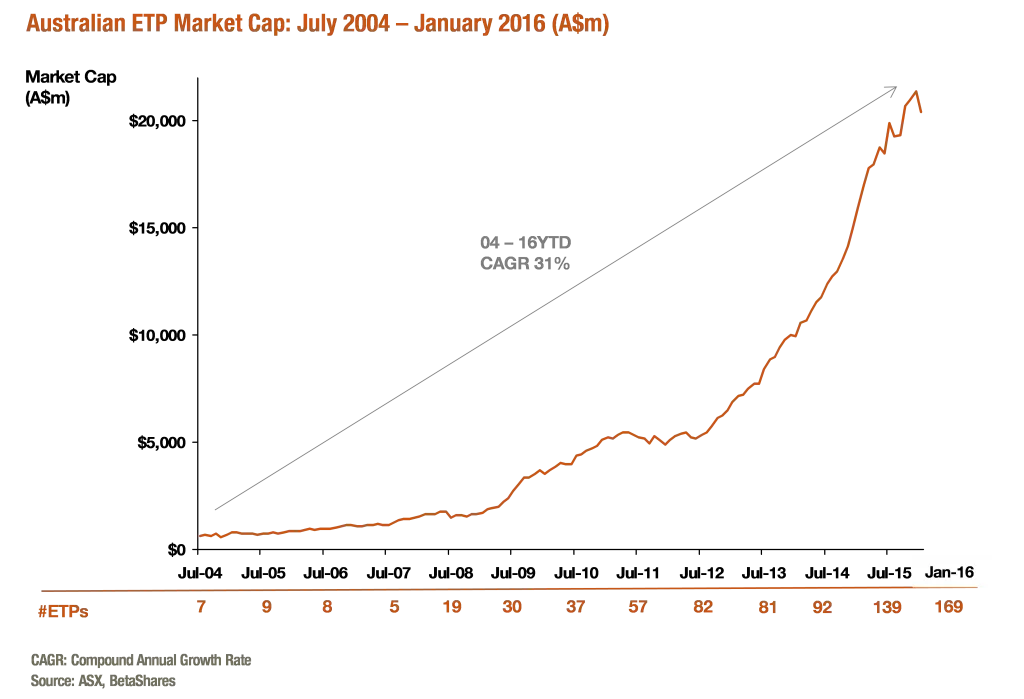

- ASX Exchange Traded Funds Market Cap: $20.4B

- Market cap growth for month: -4.3%, -$925m

- Market cap growth for last twelve months: 28.3%, +$4.5B

Comment: The industry ended the month down and was valued at $20.4B. This was a reduction of 4.3% compared to December or a full $925m for the month

New Money

- New unit growth for month (units outstanding by number): 0.2%

- Net new money (units outstanding by $ value): +$104.8m

Comment: Notwithstanding a very poor month for asset values, the industry’s structural growth was actually positive, eking out a small net inflow for the month.

Products

- 169 Exchange Traded Products trading on the ASX

- No new products launched this month

Trading Value

Trading value decreased -3% month on month

Performance

Best performers this month were the BetaShares Strong Bear Hedge Funds, BBUS (+12.9%) and BBOZ (+12.0%)

Comment: Tactical investors accessing short exposures on the ASX, amongst the market turmoil, through the BetaShares Strong Bear Hedge Funds were rewarded with the best performing funds of the month.

Top 5 category inflows (by $) – January 2016

| Category | Inflow Value | |

| Aus. High Yield | $75,805,455 | |

| International Equities – Developed | $63,624,436 | |

| Cash | $50,295,390 | |

| Aus. Fixed Income | $29,185,469 | |

| International Equities – Emerging Markets | $17,141,586 | |

Comment: In what could be seen as a sign of investors looking to protect against the ongoing market volatility, the largest product for net inflows was the BetaShares Australian High Interest Cash ETF (AAA) which took in ~$50m for the month.

Top category outflows (by $) – January 2016

| Category | Outflow Value | |

| Aus. Equities – Broad | ($117,635,050) | |

| Currency | ($20,385,000) | |

| Aus. Equities – Small Cap | ($13,583,440) | |

| Aus. Equities – Large Cap | ($11,376,720) | |

| Financials Sector | ($9,694,755) | |

Comment: Significant selling was sustained by Australia’s largest ETF, STW, which received net outflows of ~$145m – in general Australian equities exposures (other than high yield) received outflows, including broad market, small cap and large cap exposures.

While 2016 began with significant market volatility, leaving some investors understandably cautious, the depth of products now available in the Australian exchange traded fund industry now gives investors options – and even opportunities to protect or benefit during the turmoil.

Will the volatility continue? How will the exchange traded fund industry respond? All will be revealed as the year progresses. Stay tuned!

Ilan Israelstam is the Head of Strategy & Marketing for BetaShares. BetaShares is an Australian manager of funds which are traded on the Australian Securities Exchange. BetaShares offers a range of exchange traded funds which cover Australian and international equities, cash, currencies, commodities and alternative strategies. Author website: www.betasharesblog.com.au/author/ilanisraelstam

This post was originally published at the BetaShares Blog at www.betasharesblog.com.au/etf-review-jan-2016